Project npv calculator

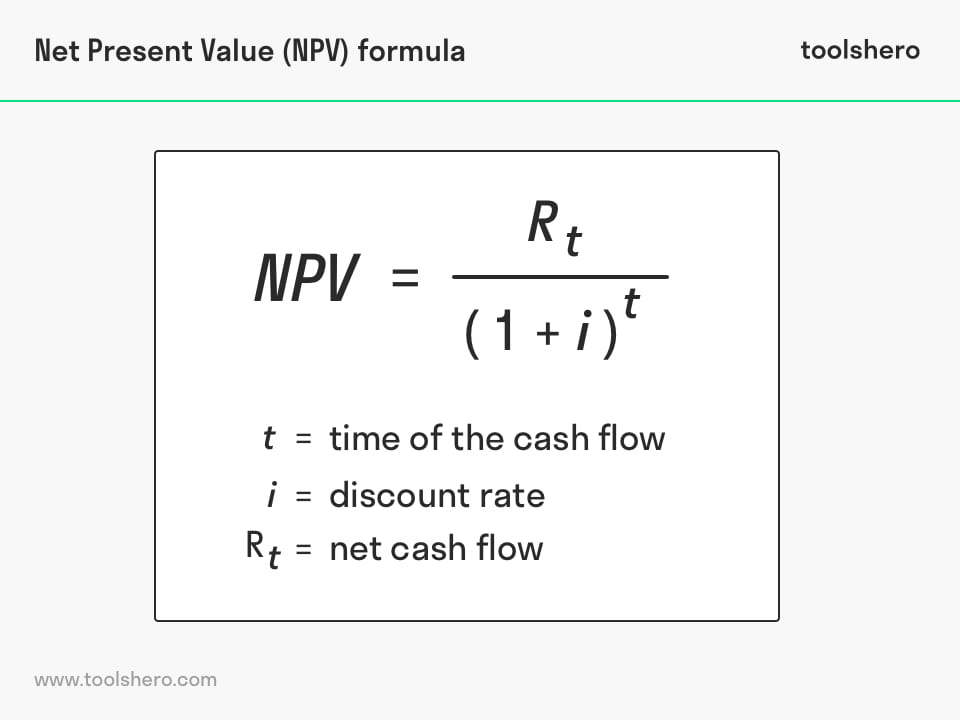

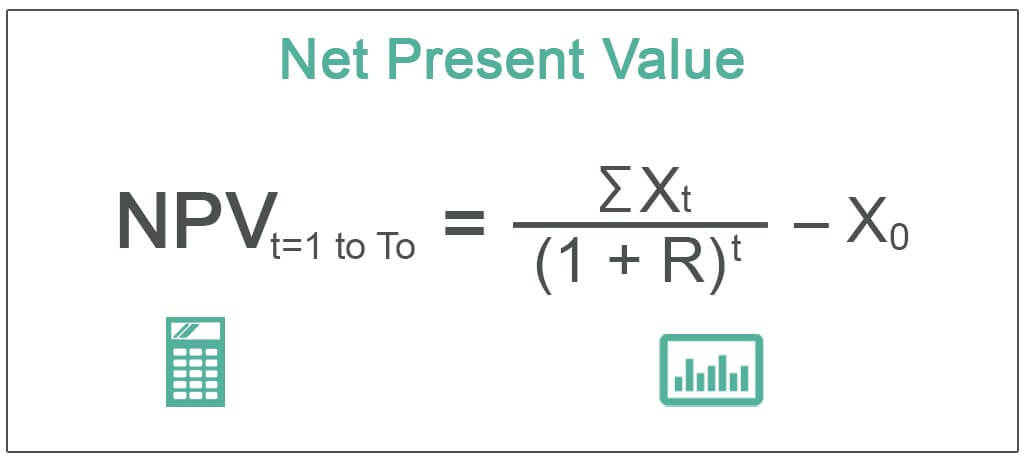

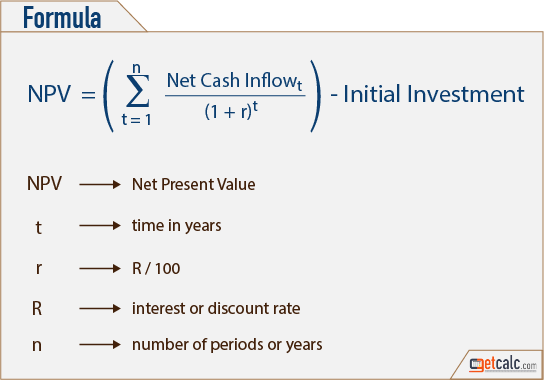

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. This net present value calculator estimates the NPV of an investment by the discounted sum of all cash flows while considering the initial cost discount rate and ins and outs.

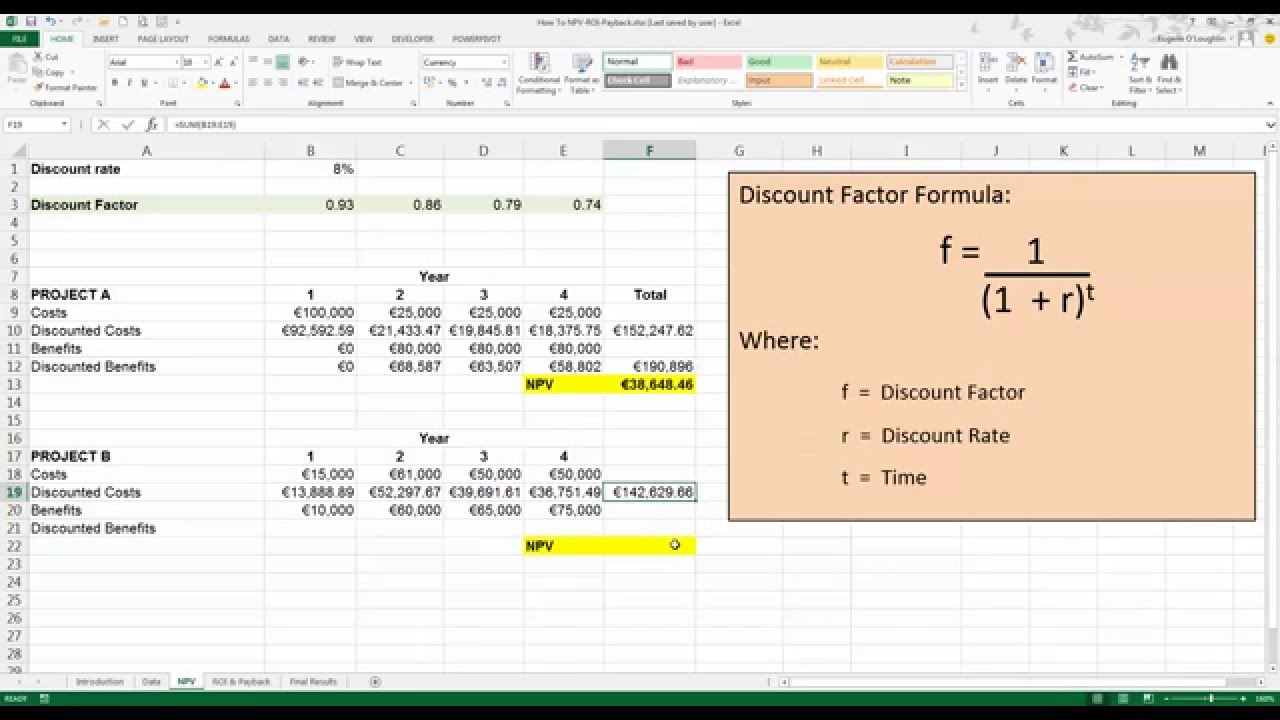

Formula For Calculating Net Present Value Npv In Excel

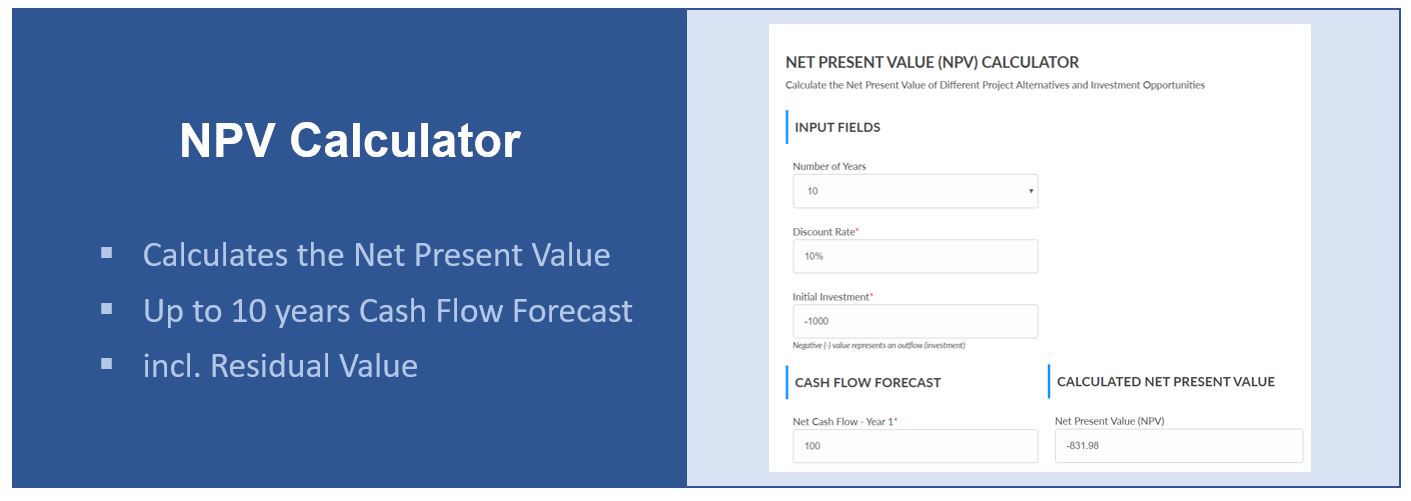

This online calculator will allow you to calculate the NPV Net Present Value of an investment.

. NPV Calculator is a free online tool to calculate NPV or Net Present Value of your project and investment for a series of cash flow. This calculation sums up the total of all adjusted cash flows accounting for inflow and. Next perform the full calculation with the initial investment.

NPV is a widely used cash-budgeting method for assessing projects and investments. Accept the project if the NPV result is zero or positive. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula.

You can easily calculate the NPV in the Excel template provided. Net present value NPV is the present value of all future cash flows of a project. A negative NPV result means the project wont be profitable and should be rejected.

Net Present Value - NPV. The NPV Calculator provides NPV. Calculate Net Present Value.

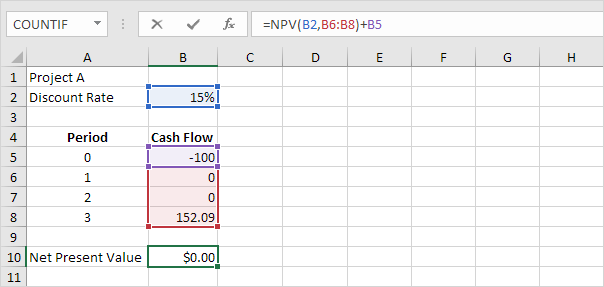

NPV is the sum of the present valuePV of the future individual cash flows including in flows and out flows. Step 1 Find the present value of the cash inflows. 1 The NPV function in Excel is simply NPV and the full formula.

Step 2 Find the sum total of the present values. In the simplest terms. Below are examples of how to.

The NPV calculator considers the expenses revenue and capital costs to determine the worth of an investment or project. The net amount of cash received of lost because of the investment project at the end of the period. An NPV calculator is a valuable tool for investors.

This NPV calculator automatically transforms every initial investment to a negative value. NPV Todays value of expected future cash flows Todays value of invested cash An NPV of greater than 0 indicates that a project has the. More specifically you can calculate the present value of uneven cash flows or even cash flows.

To understand this term better you first need to understand the term present value. Because the time-value of money dictates that money is worth more now than it is in the future the value of. Net present value NPV and internal rate of return IRR are two closely related finance calculations that are used.

The calculation is based on the initial investment and the. Calculate the net present value NPV of a series of future cash flows. Where r is the discount rate and t is the number of.

To calculate the net present value the user must enter a Discount Rate The Discount Rate is simply your desired rate of return ROR. What is net present value NPV and how to calculate NPV. Step 3 NPV Calculation.

In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. It helps in determining if it is worth pursuing an investment. This NPV IRR calculator is for those analyzing capital investment decisions.

What Is A Good Npv Quora

How To Calculate Net Present Value Npv In Excel 2013 Youtube

Net Present Value Npv Formula And Calculator

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

How To Calculate Net Present Value Npv In Excel Youtube

What Is The Net Present Value Npv Definition Formula Toolshero

Net Present Value Calculator

Npv Calculator Calculate Net Present Value

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

Npv Formula In Excel In Easy Steps

Net Present Value Npv Meaning Formula Calculations

Net Present Value Npv Calculator Project Management Info

How To Calculate Npv In Rational Portfolio Manager

Net Present Value Npv Calculator

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Net Present Value Npv Formula And Calculator

Formula For Calculating Net Present Value Npv In Excel